Daftar perusahaan menurut kapitalisasi pasar: Perbedaan antara revisi

Tag: kemungkinan menambah konten tanpa referensi atau referensi keliru VisualEditor-alih |

|||

| Baris 22: | Baris 22: | ||

! colspan=2 | Kuartal keempat<ref>[https://ft-static.com/content/images/2a53e388-569a-11e2-aa70-00144feab49a.pdf Financial Times]</ref> |

! colspan=2 | Kuartal keempat<ref>[https://ft-static.com/content/images/2a53e388-569a-11e2-aa70-00144feab49a.pdf Financial Times]</ref> |

||

|- |

|- |

||

| ⚫ | |01 || {{flagicon|United States}} || [[Apple Inc.|Apple Inc]] <br /> {{increase}}559,002.1 || {{flagicon|United States}} || [[Apple Inc.|Apple Inc]]<br /> {{decrease}}546,076.1 || {{flagicon|United States}} ||[[Apple Inc.|Apple Inc]]<br /> {{increase}}625,348.1 || {{flagicon|United States}}||[[Apple Inc.|Apple Inc]]<br /> {{decrease}}500,610.7 |

||

|- |

|- |

||

| |

|02 || {{flagicon|United States}} || [[Exxon Mobil]] <br /> {{increase}}408,777.4 || {{flagicon|United States}} || [[Exxon Mobil]] <br /> {{decrease}}400,139.1 || {{flagicon|United States}} || [[Exxon Mobil]] <br /> {{increase}}422,127.5 || {{flagicon|United States}}|| [[Exxon Mobil]]<br /> {{decrease}}394,610.9 |

||

|- |

|- |

||

| ⚫ | |||

|- |

|- |

||

| |

|04 || {{flagicon|United States}} || [[Microsoft Corporation|Microsoft Corps]] <br /> {{increase}}270,644.1 || {{flagicon|United States}} ||[[Microsoft Corporation|Microsoft Corps]]<br /> {{decrease}}256,982.4 || {{flagicon|United States}} || [[Microsoft Corporation|Microsoft Corps]]<br /> {{decrease}}249,489.8 || {{flagicon|Australia}} <br /> {{flagicon|United Kingdom}} || [[BHP Billiton|BHP]]<br /> {{increase}}247,409.0 |

||

|- |

|- |

||

|05 || {{flagicon|United States}} || [[IBM|International Business Machines Corps]] <br /> {{increase}}241,754.6 || {{flagicon|United States}} || [[Wal-Mart Stores, Inc.|Wal-Mart]] <br /> {{increase}}235,900.3 || {{flagicon|United States}} || [[ Wal-Mart Stores, Inc.|Wal-Mart]]<br /> {{increase}}248,074.4 || {{flagicon|China}} ||[[ICBC|Industrial and Commercial Bank of China]]<br /> {{increase}}236,457.9 |

|||

|- |

|- |

||

| |

|06 || {{flagicon|China}} || [[ICBC|Industrial and Commercial Bank of China]] <br /> {{increase}}236,335.4 || {{flagicon|United States}} || [[IBM|International Business Machines Corps]]<br /> {{decrease}}225,598.5 || {{flagicon|United States}} || [[General Electric Company|General Electric (GE)]]<br /> {{increase}}239,791.2 || {{flagicon|Hong Kong}} ||[[China Mobile]]<br /> {{increase}}234,040.2 |

||

|- |

|- |

||

| ⚫ | |07 || {{flagicon|The Netherlands}} <br /> {{flagicon|United Kingdom}} <!-- do not change to only NL or GB, distuptable, see discussion--> || [[Royal Dutch Shell]]<br /> {{decrease}}222,425.1 || {{flagicon|United States}} || [[General Electric Company|General Electric (GE)]] <br /> {{increase}}220,806.3 || {{flagicon|United States}} || [[IBM|International Business Machines Corps]]<br /> {{increase}}237,068.4 || {{flagicon|United States}} || [[ Wal-Mart Stores, Inc.|Wal-Mart]] <br /> {{decrease}}228,245.4 |

||

|- |

|- |

||

| |

|08 || {{flagicon|Hong Kong}} || [[China Mobile]] <br /> {{increase}}220,978.9 || {{flagicon|Hong Kong}} || [[China Mobile]]<br /> {{decrease}}219,481.3 || {{flagicon|United States}} || [[Chevron Corporation|Chevron Corps]] <br /> {{increase}}228,707.1 || {{flagicon|South Korea}} || [[Samsung Electronics|Samsung]] <br /> {{increase}}227,581.8 |

||

|- |

|- |

||

| ⚫ | |09 || {{flagicon|United States}} || [[General Electric Company|General Electric (GE)]] <br /> {{increase}}212,317.7 || {{flagicon|The Netherlands}} <br /> {{flagicon|United Kingdom}} <!-- do not change to only NL or GB, distuptable, see discussion--> ||[[Royal Dutch Shell|Royal Dutch Shell (Shell)]]<br /> {{decrease}}217,048.2 || {{flagicon|Hong Kong}} || [[China Mobile]]<br /> {{increase}}222,817.8|| {{flagicon|United States}}|| [[Microsoft Corporation|Microsoft Corps]] <br /> {{decrease}}224,801.0 |

||

|- |

|- |

||

| |

|10 || {{flagicon|United States}} || [[Chevron Corporation|Chevron Corps]] <br /> {{increase}}211,950.6 || {{flagicon|China}} ||[[ICBC|Industrial and Commercial Bank of China]]<br /> {{decrease}}211,196.0 || {{flagicon|The Netherlands}} <br /> {{flagicon|United Kingdom}} <!-- do not change to only NL or GB, distuptable, see discussion--> || [[Royal Dutch Shell|Royal Dutch Shell (Shell)]]<br /> {{increase}}222,669.6 || {{flagicon|The Netherlands}} <br /> {{flagicon|United Kingdom}} <!-- do not change to only NL or GB, distuptable, see discussion-->||[[Royal Dutch Shell|Royal Dutch Shell (Shell)]]<br />{{steady}}222,669.6 |

||

|- |

|||

| ⚫ | | |

||

|- |

|||

|- |

|||

| ⚫ | | |

||

|- |

|||

|- |

|||

| ⚫ | | |

||

|- |

|||

|- |

|||

| ⚫ | | |

||

|- |

|||

|- |

|||

| 10 || {{flagicon|United States}} || [[Chevron Corporation|Chevron]] <br /> {{increase}}211,950.6 || {{flagicon|China}} ||[[ICBC|Industrial and Commercial Bank of China]]<br /> {{decrease}}211,196.0 || {{flagicon|The Netherlands}} <br /> {{flagicon|United Kingdom}} <!-- do not change to only NL or GB, distuptable, see discussion--> || [[Royal Dutch Shell|Shell]]<br /> {{increase}}222,669.6 || {{flagicon|The Netherlands}} <br /> {{flagicon|United Kingdom}} <!-- do not change to only NL or GB, distuptable, see discussion--> || [[Royal Dutch Shell|Shell]]<br /> {{steady}}222,669.6 |

|||

|- |

|- |

||

|- |

|- |

||

Revisi per 24 Juli 2021 03.13

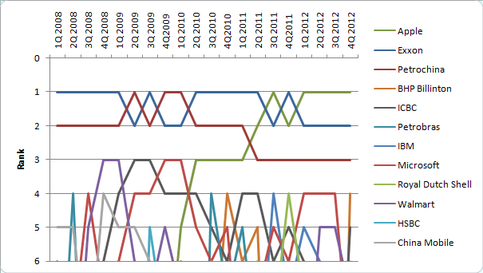

Berikut adalah daftar perusahaan umum dengan kapitalisasi pasar terbesar, serta perusahaan milik negara menurut perkiraan nilai pasar. Kapitalisasi pasar dihitung dari harga saham (tercatat pada hari tertentu) dikali jumlah saham yang dikeluarkan. Jumlah ditukar ke dalam satuan juta dolar Amerika Serikat (nilai tukar pada hari tertentu) agar bisa diperbandingkan.

Sejumlah perusahaan milik negara lebih besar daripada perusahaan umum terbesar. Misalnya, nilai Saudi Aramco diperkirakan mencapai $781 miliar [1] sampai $2 triliun USD, lebih dari 02. kali ukuran perusahaan apapun dalam daftar ini dan menjadikannya perusahaan paling bernilai di dunia.[2]

Perusahaan umum

Kapitalisasi pasar

Pada tanggal 22 Agustus 2012, Apple Inc. menutup perdagangan dengan harga saham $668,87.[3] Dengan 936.596.000 lembar saham (30 Juni 2012),[4] Apple mempunyai kapitalisasi pasar senilai $627 miliar. Ini merupakan kapitalisasi pasar nominal tertinggi yang pernah dicapai oleh perusahaan umum.

Rekor sebelumnya dipegang oleh Microsoft sejak 30 Desember 1999 ketika mereka mencapai harga saham $119,94 pada tengah hari.[5] Dengan 5.160.024.593 lembar saham (30 November 1999),[6] kapitalisasi pasanya mencapai $618,9 miliar. Jika disesuaikan dengan inflasi tahun 2012, kapitalisasi pasar Microsoft bisa mencapai $846 miliar, sebuah nilai kapitalisasi sesuai inflasi yang belum tercapai oleh Apple Inc dan Walmart Inc.[7]

2012

Daftar Financial Times Global 500 ini sesuai tanggal Juni 2013. Perubahan nilai pasarnya relatif terhadap kuartal sebelumnya.

2011

Daftar Financial Times Global 500 ini sesuai tanggal 31 Desember 2011. Perubahan nilai pasarnya relatif terhadap kuartal sebelumnya.

2010

Daftar Financial Times Global 500 ini sesuai tanggal 31 Desember 2010. Perubahan nilai pasarnya relatif terhadap kuartal sebelumnya.

2009

Daftar Financial Times Global 500 ini sesuai tanggal 31 Desember 2009. Perubahan nilai pasarnya relatif terhadap kuartal sebelumnya.

2008

Daftar Financial Times Global 500 ini sesuai tanggal 31 Desember 2008. Perubahan nilai pasarnya relatif terhadap kuartal sebelumnya.

Perusahaan milik negara

Daftar Financial Times Non-Public 150 ini sesuai bulan Desember 2006. Daftar ini memperkirakan Saudi Aramco pada nilai US$0,781 triliun. Perkiraan terbaru pada tahun 2015 menempatkan nilainya pada kisaran US$2,3 triliun [28] hingga US$10.00 triliun.[29]

| Peringkat | 2017 [1] | |

|---|---|---|

| 01 | Saudi Aramco (priv.) 781,000 | |

| 02 | Pemex 415,000 | |

| 03 | Petróleos de Venezuela (priv.) 388,000 | |

| 04 | Kuwait Petroleum Corporation (priv.) 378,000 | |

| 05 | Petronas (priv.) 232,000 | |

| 06 | Sonatrach (priv.) 224,000 | |

| 07 | National Iranian Oil Company (priv.) 220,000 | |

| 08 | Japan Post (priv.) {2007} 156,000 | |

| 09 | Pertamina (priv.) 140,000 | |

| 10 | Nigerian National Petroleum Corps 120,000 | |

Lihat pula

- Daftar perusahaan menurut pendapatan

- Daftar perusahaan menurut jumlah karyawan

- Daftar perusahaan menurut laba dan rugi

Catatan kaki

- ^ a b FT Non-Public 150 - the full list

- ^ "Big Oil, bigger oil". Financial Times. February 4, 2010.

- ^ http://www.google.com/finance?q=AAPL

- ^ http://files.shareholder.com/downloads/AAPL/1987632841x0x585701/beacb369-cb95-4950-acf4-4fbfa3569ec6/Q3_2012_Form_10-Q_As-Filed_.pdf

- ^ http://www.microsoft.com/investor/reports/ar00/notes-quarterly_information.htm

- ^ http://secfilings.nasdaq.com/filingFrameset.asp?FileName=0001032210%2D01%2D000273%2Etxt&FilePath=%5C2001%5C02%5C14%5C&CoName=MICROSOFT+CORP&FormType=10%2DQ&RcvdDate=2%2F14%2F2001&pdf=

- ^ http://finance.yahoo.com/news/apple-market-value-hits-600b-151007997.html

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2010-10-11. Diakses tanggal 2010-10-11.

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2009-12-29. Diakses tanggal 2009-12-29.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2011-05-20. Diakses tanggal 2011-05-20.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2011-07-25. Diakses tanggal 2011-07-25.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2010-03-13. Diakses tanggal 2010-03-13.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2008-09-10. Diakses tanggal 2008-09-10.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2008-09-10. Diakses tanggal 2008-09-10.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2009-02-05. Diakses tanggal 2009-02-05.

- ^ "Financial Times" (PDF). Diarsipkan (PDF) dari versi asli tanggal 2009-03-27. Diakses tanggal 2009-03-27.

- ^ Sheridan Titman, McCombs School of Business, March 1, 2010. More Thoughts on the Value of Saudi Aramco http://blogs.mccombs.utexas.edu/titman/2010/03/01/more-thoughts-on-the-value-of-saudi-aramco/[pranala nonaktif permanen]

- ^ Financial Times, February 4, 2010. Big Oil, bigger oil: http://www.ft.com/cms/s/c5b32636-116f-11df-9195-00144feab49a,_i_email=y,Authorised=false.html?_i_location=http%3A%2F%2Fwww.ft.com%2Fcms%2Fs%2F3%2Fc5b32636-116f-11df-9195-00144feab49a%2C_i_email%3Dy.html&_i_referer=http%3A%2F%2Ftexasenterprise.org%2Farticle%2Fwhats-value-saudi-aramco